Articles

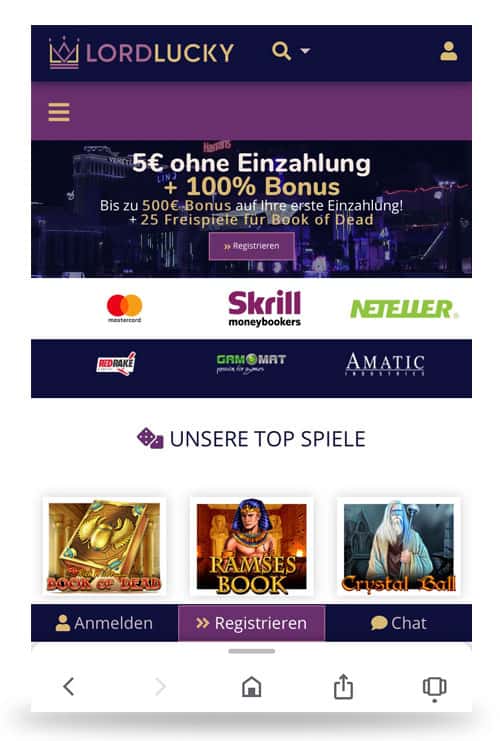

The newest AI-motivated security infrastructure constantly monitors purchases, getting defense one to exceeds conventional fraud detection. With no modern jackpot or true added bonus mini-feature, Split Da Financial Once more is approximately their incentive spin element. Landing around three, five, or five container signs brings in your 15, 20, or twenty-five 100 percent free revolves correspondingly. People earn in these 100 percent free spins will pay 5x, and you will including we mentioned earlier within Crack Da Bank Once again online pokies comment, crazy victories inside the incentive games spend 25x. Appearing a supplementary container symbol within the bonus rounds honors you a supplementary fee twist. While there is some “already been through it complete you to definitely” using this type of slot follow up, in itself Crack Da Financial once more are an enjoyable-enough pokie that gives ample possible opportunity to, well, break da financial.

Security measures should go beyond basic password defense to incorporate robust authentication procedures and you can clear protocols to possess addressing possible items. A knowledgeable assistance structures merge receptive solution having hands-on security features, ensuring you have access to help quickly while maintaining your financial analysis secure. If the on line account supports they, you might constantly make use of your debit card to put bucks from the an atm one to allows places. Specific on the web accounts need you to visit a great using retailer instead. The Friend Lender online bank account, it phone calls the newest Using Account, will pay interest to your all stability. Nevertheless rates of interest are tiered — for top rate, you’ll you desire no less than $15,one hundred thousand in your membership.

Exchange may well not fit small businesses prioritizing desire-results account or requiring business loans, since the platform is targeted on checking account as opposed to large-give options or credit characteristics. Enterprises wanting regular department access otherwise frequent global purchases may need additional banking services. To own solamente entrepreneurs otherwise enterprises which have easy financial needs — for example solitary membership administration and you can limited month-to-month purchases — Relay’s multiple-membership structure you’ll meet or exceed their requirements. The quality plan is available free of charge and you will boasts key banking have and numerous examining account.

In-application traveling reservation and you can administration

SVB serves campaign-supported startups and you can tech enterprises looking to traditional banking services of a keen business always the brand new tech field. The bank aligns with companies demanding founded commercial financial items within technology ecosystem. Silicon Area Financial now operates since the a department away from Very first Owners Lender after its acquisition within the 2023. The lending company, created in 1983, became to cope with over $two hundred billion in the assets by the offering technical enterprises and startups ahead of its change.

As a result of a collaboration which have Line NA (Member FDIC), the working platform provides checking account, treasury account, and you can container membership in a single software. So it combination lets organizations to view and you will do its whole financial surgery in one program and have lengthened FDIC https://in.mrbetgames.com/why-to-play-lights/ visibility, while you are automated have handle routine tasks including transfers and expenses payments. The newest included construction allows organizations in order to size their financial operations as opposed to the traditional difficulty of controlling numerous financial relationships. While the enterprises search more efficient financial alternatives, Brex have emerged since the a noted athlete by partnering business treasury management, purchase control, and you can automation for the a good harmonious electronic financial system. Discover also offers a pleasant kind of inexpensive basic banking characteristics, from checking account in order to Cds and fund. You can generate cash back whether you use an excellent debit credit or credit cards.

Relay

- This type of membership in addition to have a tendency to provide benefits for example money back for the debit purchases.

- Top-ranked creditors features low if any lowest opening places, as well as many different name possibilities and specialization Dvds to own independency.

- The new conversion process away from company banking has expidited lately, while the electronic development reshapes how businesses create their financial procedures.

- Find offers an enjoyable group of rewarding however, cheap account (no month-to-month costs) that will serve as a substantial basis for all your earliest financial means.

- The lending company’s huge stone-and-mortar exposure, paired with an enthusiastic changing package out of on the internet devices, kits they other than other customary financial institutions.

Discover’s costs on the deals account, money business profile (MMAs), and you can permits from put (CDs) are a lot higher than the newest national average. However they’re not at all times one of the best selling you can find on the high-produce discounts account, MMAs, and you can Dvds. Of course, the origin of the idiom “hurt you wallet” try financial. Scholars believe the phrase “break the bank” got its start some time around 1600, when bettors claimed additional money compared to the family (bank) you may afford to shell out. Specific put the term’s source closer to 1873, whenever a roulette to play Englishman named Joseph Jagger obtained $350,100 (a huge sum for the day) from the Monte Carlo. A knowledgeable results check out banks, financing and fintech enterprises with high rates and reduced or no charges otherwise lowest opening deposits.

Make your offers and you can do financial obligation to keep their financial!

You can dig tunnels, explore explosives, bore with lasers, destroy which have wrecking golf balls, play with an excellent teleporter if you don’t a great disguise! Make sure to enjoy Damaging the Bank multiple times to get all the endings. You can find all Henry Stickman game to your Poki in order to play for free online today. “My standard bank features updated the cellular application and is also an easy method greatest feel to have users,” you to respondent told you. RaShawn Mitchner are a good MarketWatch Instructions people elderly publisher layer personal money topics and you may insurance coverage.

Brex also provides competitive production as opposed to old-fashioned financial limits. Companies have access to their money with one hundred% exchangeability with no minimum equilibrium criteria when you’re getting output on their dumps. That it capacity to improve team cashflow reflects a modern-day method in order to corporate financial, partnering antique monetary features that have newest technical. Yes, on the web examining profile is secure whenever loan providers get procedures so you can stop defense breaches and also you realize guidelines to own electronic banking. Your bank account is additionally protected from a lender failure after you explore an establishment which have insurance rates on the NCUA (for borrowing unions) or FDIC (to possess financial institutions) insurance. Of many on the internet examining profile render very early head deposit, a service you to definitely launches your direct dumps around two days prior to when your’lso are planned to get the bucks.

If you would like access their paycheck very early, choose an on-line savings account which provides this particular aspect. And if your bank account harmony try between $dos,five-hundred and you may $99,999.99, you’ll earn focus. The fresh APY increases in order to 0.15% APY for checking account stability out of $one hundred,100000 or more.

Brex’s has line up such well with a high-development startups and scaling organizations looking to modernize the financial procedures. Technology organizations and you can strategy-backed businesses is also power the newest provided corporate notes, costs government, and you will financial services. Investopedia are founded inside 1999 possesses started providing customers come across the best on the web bank accounts because the 2021. Investopedia’s search and you can editorial organizations used independent look to your on the internet banking companies, gathering and you can calculating more 700 analysis things to the 19 banking institutions and you will borrowing from the bank unions. Banking companies and credit unions have been evaluated according to their product offerings (examining, offers, etcetera.), fees, APYs, usage of, and you can buyers reviews.

The newest Expert package, during the $29 for each and every company monthly, will bring new features as well as same-time ACH running, cable transfers as opposed to costs, and you will automated profile payable. Enterprises may start on the basic package and changeover so you can Specialist as their means build. Exactly what set Brex aside on the economic technical land is actually their holistic method of team financial.

As to the reasons Break Da Lender Again Is worth To try out

Through providing a complete-fledged bank account less than Column Letter.A., Representative FDIC, near to increased treasury and vault features, Brex ensures all of the dollars try optimized. High-produce put membership shield critical supplies, backed by FDIC insurance all the way to $six million as a result of a system away from spouse banks. You can do the brand new Varo Savings account (the firm’s name because of its on line savings account) having an intuitive, user-friendly mobile application that lets you deposit monitors, establish transfers and permit very early direct dumps. The fresh application also makes you send bucks because of Zelle, song your own investing and you can talk to customer support.

The necessities plan can be found free of charge, bringing enterprises which have key economic devices as well as a great Brex company account no month-to-month provider otherwise cable transfer charges. This plan has team banking, global corporate cards, costs shell out features, and you will very first costs management, as well as usage of high-yield treasury services. Cash places with on line examining membership work in different ways than simply having stone-and-mortar banks.